Take Control of Your Debt & Your Future with Green Line Loans

Green Line doesn't just help you get loans. We help provide some breathing room. A way to stop the calls, lower your monthly payments, and start rebuilding your credit—for real.

Green Line helps everyday people like you break free from predatory loan traps or high-interest credit cards to finally get ahead. Whether that’s through a low fixed-rate personal loan or a strategic debt management plan. No judgment. No pressure. Just a clear path forward—and someone walking it with you.

Licensed

100% 5-Star Reviews

We Solve the Financial Problems Keeping You Up at Night

Getting funding shouldn’t feel like pulling teeth—or worse, risking your credit just to see what’s out there. Whether you're trying to consolidate credit card debt, escape high APR traps, or just make a big move—this is built for you. Green Line in Warrenville, IL can help those throughout the U.S. get a personal loan.

Financial Services Designed to Help You Breathe Easier and Build Back Better

Why People Choose Green Line Financial Services

We’ve helped hundreds of people in situations just like yours knock down monthly payments by getting them into a smarter financing option—with no collateral and zero risk to their credit during the application.

Expertise

Our team of financial consultants has years of experience in the industry, enabling us to provide expert advice and personalized solutions tailored to your needs.

Credit Improvement Focus

Our debt resolution approach not only helps clients reduce their debt but also improves their credit scores within 2 years, compared to the standard 7-year period for credit recovery.

Transparency

We provide clear and concise information, ensuring you understand the terms, conditions, and potential implications of each loan option.

Customer-Centric Approach

We work closely with you, providing ongoing support and guidance throughout the loan application process.

Trust and Integrity

We uphold the highest standards of integrity, maintaining confidentiality and ensuring your personal information is handled with utmost care and security.

Cost Efficiency

Our clients save between $200 and $800 per month on their minimum payments by exploring smarter financial solutions.

Our Easy 3-Step Process for a Hassle-Free Experience

We're not a lender—we’re the affiliate that gets you the real deal and negotiates better terms with lawyers and lenders on your behalf.

01

Need Analysis

We discuss what your desired outcome is, identify core problems, ask qualifying questions, and bridge the gap to find the best path forward.

02

Loan Options

Whether you qualify for a personal loan or need a smarter debt solution, Green Line can provide you options and help you take the best next step for your financial future.

03

Approval & Loan Disbursement

Once your loan is approved, money hits your account fast—usually in 1–3 days. If a loan isn’t possible, we pivot to a custom plan that still puts you ahead.

Our Roof Repair & Replacement Projects in Bensenville

Explore our stunning roofing projects and transformations.

What Our Clients Are Saying About Green Line Financial Services

"I got a $15,000 loan to pay off some high-interest credit cards, and honestly, Green Line made it so easy. He explained everything clearly and kept me in the loop the whole time."

"I needed $8,000 for emergency home repairs and Green Line was able to quickly come through. Adam made everything easy to understand. Solid experience overall!"

"Green Line helped us fund our dream wedding with a $20,000 loan. Adam made it all feel easy and took all our worries away. So grateful!"

Latest Roofing Insights

Title

Title

Title

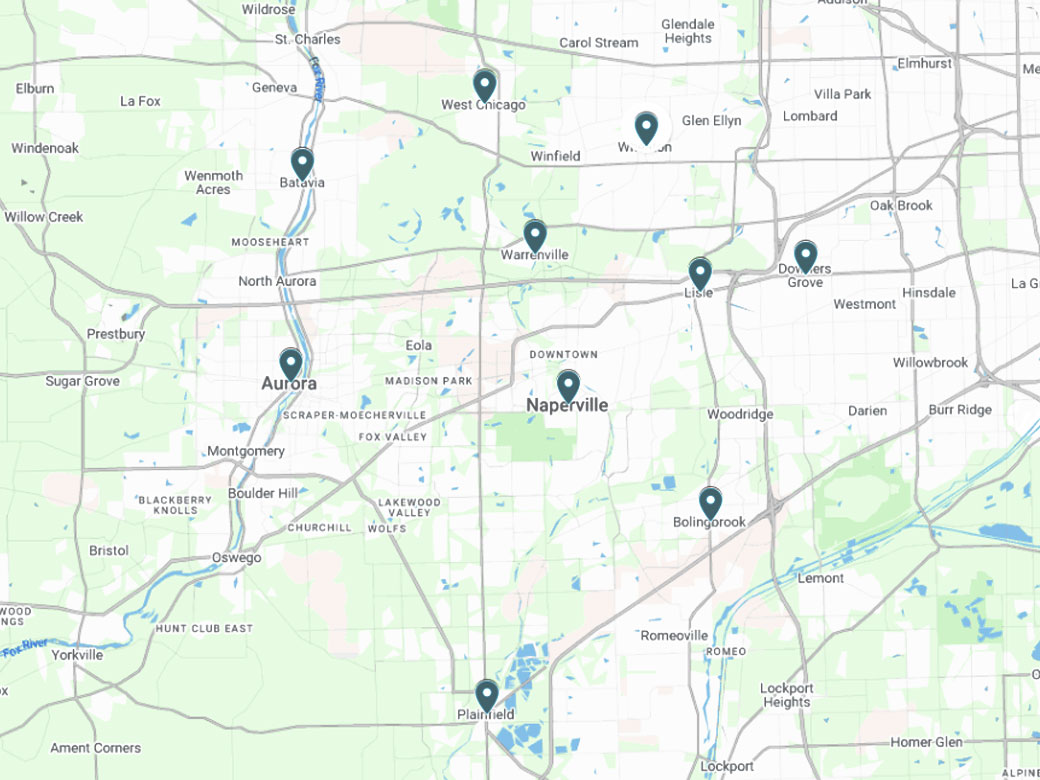

Green Line Services These Nearby Areas & Nationwide

- Aurora

- Batavia

- Bolingbrook

- Downers Grove

- Joliet

- Lisle

- Naperville

- Plainfield Warrenville

- West Chicago

- Wheaton

FAQs

Will applying for a loan hurt my credit score?

No. We use a soft credit check that won’t impact your credit just to view your options.

Do I need collateral or a good credit score to apply?

Nope. These personal loans are 100% unsecured, and we work with all credit types—even if you’ve been denied before.

What if I don’t qualify for a loan—do I have any other options?

Absolutely. If a personal loan isn’t the right fit, Green Line will guide you into a proven debt resolution plan that helps reduce your monthly payments and rebuild your credit.

Are your services legit? This sounds too good to be true.

We get it—and that’s why we’re transparent. No surprise fees, no hard pulls to view your offer, and personal guidance every step of the way.

Is this the same as payday lending?

Definitely not! Our solutions are built to get you out of the payday trap—not deeper into it.

Can you help me improve my credit score?

Yes. Our debt resolution plans are designed to reduce your debt and improve your credit score over time, often within 24 months, compared to playing the waiting game for 7 years.

What do I need in order to apply?

Before you close your loan, we’ll need the following documentation from you:

- Proof of identity – a driver’s license, state-issued ID card, passport, or available third-party verification service.

- Proof of residence – a driver’s license with current address, utility bill, or signed lease.

- Proof of income – pay stubs or tax returns.

We may ask for additional items based on your unique situation. Ready to apply? Start my personal loan application.

How soon can I get funded if I qualify for a loan?

Most of our clients receive funding within 1-3 business days after approval.

How will I receive my funds?

By direct deposit ‐ Get your funds deposited directly into your checking or savings account.

Start your application now, and you could receive your funds the same day your loan is approved.

How are my loan terms decided?

They base loan decisions on a variety of factors, including credit history, income, expenses, and availability and value of collateral (if applicable).

Each customer’s loan terms are offered based on these factors and the customer’s ability to repay, so that each customer can make a decision based on their unique situation and needs.

How do I get started?

It only takes 60 seconds to check your loan options—with zero impact on your credit score. From there, Green Line guide you every step of the way.

Your Future Doesn’t Have to Wait

You’ve done the hard part—looking for a real solution. Now let us do what we do best: help you take control, lower your payments, and rebuild stronger than before.

Whether you’re approved for a personal loan or find freedom through our debt resolution plan, Green Line is with you from day one to done.

No confusion. No runaround. Just progress.